PETRONAS to cut cost by 30%

KUALA LUMPUR: Petroliam Nasional Bhd (Petronas) is seeking to slash its expenditure by 30% from the amount it spent in its 2006 fiscal year.

KUALA LUMPUR: Petroliam Nasional Bhd (Petronas) is seeking to slash its expenditure by 30% from the amount it spent in its 2006 fiscal year.

“There must be shared misery. We must have a hard look at costs,’’ said president and CEO Tan Sri Mohd Hassan Marican.

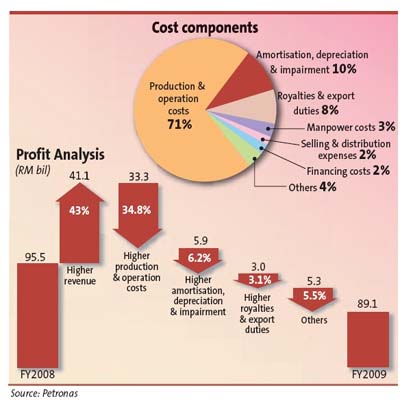

Higher cost was the main culprit for Petronas announcing a drop in yearly profit, said Hassan, as the country’s largest company announced a 14% drop in net profit to RM52.5bil for its 2009 financial year (FY) from RM61bil in FY08.

Revenue, however, increased by 18.4% to RM264.2bil largely thanks to higher liquefied natural gas prices and higher sales of petroleum products.

Speaking with editors at a briefing, Hassan said Petronas was not alone in going for such huge cost cuts as all the oil majors were doing the same. Petronas said costs, such as for steel and charges by service providers, remained high and even crept up despite a drop in the demand and price of crude oil.

Hassan was also upset to read smearing comments being made about its staff in view of how costs have risen.

“Employees here have worked hard and diligently. Such comments are unfair,’’ he said, adding that staff cost was only 3% of total cost last year.

While cost cutting would be pursued, Hassan said capital expenditure domestically would not be affected as spending by Petronas had a huge multiplier effect on the Malaysian economy.

“We plan to spend the same level this financial year to sustain production levels,’’ he said, adding that spending had to go on regardless of the price of crude oil to continue developing reserves.

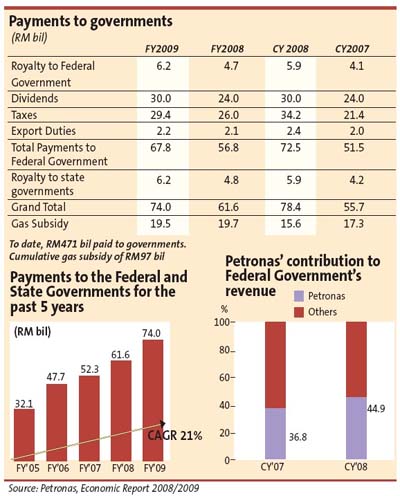

The drop in profits did not, however, affect its payment to the Government. In fact, payment to the Government rose to RM74bil from RM61.6bil as the higher price environment prior to the huge decline in prices had meant higher royalty payments, export duties and taxes. Petronas also raised its dividends to RM30bil in FY09 from RM24bil in FY08.

The decline in profits and payment obligation to the Government had led to Petronas retaining a much smaller percentage of profits compared with other national oil companies and oil majors.

As a result, Petronas would tap into its reserves and the company would raise funds by issuing bonds. Petronas last tapped the capital markets in 2002 to raise funds.

The last time Petronas dipped into its coffers to fund its operations was during the 1997/98 period, said Hassan. “We also need to go out and borrow. We will look to raise funds as the cost of funds are low,’’ he said.

Another element that has not worked in Malaysia’s favour as a result of the production cuts by the Organisation of Petroleum Exporting Countries (Opec) has been the price of Tapis, the blend of Malaysia’s light crude oil.

The average price of Malaysian crude oil last year was US$88 a barrel and in May, the price was US$51.08.

At the peak of the oil rally last year, the price of Tapis made crude oil from Malaysia the world’s most expensive oil. But now, it is cheaper than a number of heavier crude oil blends.

Hassan said this anomaly was due to Opec cutting the supply of heavier crude instead of lighter crude. As refineries have sophisticated facilities that require heavy oils be put into the system, that has worked to keep the price of the heavier crude price up.

Hassan said newer finds of new hydrocarbon resource in Malaysia had been in deeper and more remote areas.

He said the latest high pressure/high temperature find proved there were hydrocarbon reserves in the South China Sea and the sizeable find made it viable for the oil service providers to start exploration work there.

“This is important for us as our acreages mature,’’ he said.

But the drawback is such wells cost twice as much as one on the continental shelf, where reserves are depleting at 12% per year.

As more exploration is conducted for deepwater reserves, the portion of such reserves to the total amount also increases. Hassan said deepwater reserves now accounted for 15% of total reserves.

As a result of the depletion of reserves, and when more new reserves are in the form of gas instead of oil, Malaysian crude oil production has also slowly declined. Production in 2009 was 553,000 barrels a day. The peak was about 700,000 barrels a day.

“We have both a volume and price contraction. We must be wise enough in the use of our hydrocarbon resources,’’ Hassan said.

|

However, domestic capital spending to continue KUALA LUMPUR: Petroliam Nasional Bhd (Petronas) is seeking to slash its expenditure by 30% from the amount it spent in its 2006 fiscal year. “There must be shared misery. We must have a hard look at costs,’’ said president and CEO Tan Sri Mohd Hassan Marican. Higher cost was the main culprit for Petronas announcing a drop in yearly profit, said Hassan, as the country’s largest company announced a 14% drop in net profit to RM52.5bil for its 2009 financial year (FY) from RM61bil in FY08. Revenue, however, increased by 18.4% to RM264.2bil largely thanks to higher liquefied natural gas prices and higher sales of petroleum products. Speaking with editors at a briefing, Hassan said Petronas was not alone in going for such huge cost cuts as all the oil majors were doing the same. Petronas said costs, such as for steel and charges by service providers, remained high and even crept up despite a drop in the demand and price of crude oil. Hassan was also upset to read smearing comments being made about its staff in view of how costs have risen. “Employees here have worked hard and diligently. Such comments are unfair,’’ he said, adding that staff cost was only 3% of total cost last year. While cost cutting would be pursued, Hassan said capital expenditure domestically would not be affected as spending by Petronas had a huge multiplier effect on the Malaysian economy. “We plan to spend the same level this financial year to sustain production levels,’’ he said, adding that spending had to go on regardless of the price of crude oil to continue developing reserves. The drop in profits did not, however, affect its payment to the Government. In fact, payment to the Government rose to RM74bil from RM61.6bil as the higher price environment prior to the huge decline in prices had meant higher royalty payments, export duties and taxes. Petronas also raised its dividends to RM30bil in FY09 from RM24bil in FY08. The decline in profits and payment obligation to the Government had led to Petronas retaining a much smaller percentage of profits compared with other national oil companies and oil majors. As a result, Petronas would tap into its reserves and the company would raise funds by issuing bonds. Petronas last tapped the capital markets in 2002 to raise funds. The last time Petronas dipped into its coffers to fund its operations was during the 1997/98 period, said Hassan. “We also need to go out and borrow. We will look to raise funds as the cost of funds are low,’’ he said. Another element that has not worked in Malaysia’s favour as a result of the production cuts by the Organisation of Petroleum Exporting Countries (Opec) has been the price of Tapis, the blend of Malaysia’s light crude oil. The average price of Malaysian crude oil last year was US$88 a barrel and in May, the price was US$51.08. At the peak of the oil rally last year, the price of Tapis made crude oil from Malaysia the world’s most expensive oil. But now, it is cheaper than a number of heavier crude oil blends. Hassan said this anomaly was due to Opec cutting the supply of heavier crude instead of lighter crude. As refineries have sophisticated facilities that require heavy oils be put into the system, that has worked to keep the price of the heavier crude price up. Hassan said newer finds of new hydrocarbon resource in Malaysia had been in deeper and more remote areas. He said the latest high pressure/high temperature find proved there were hydrocarbon reserves in the South China Sea and the sizeable find made it viable for the oil service providers to start exploration work there. “This is important for us as our acreages mature,’’ he said. But the drawback is such wells cost twice as much as one on the continental shelf, where reserves are depleting at 12% per year. As more exploration is conducted for deepwater reserves, the portion of such reserves to the total amount also increases. Hassan said deepwater reserves now accounted for 15% of total reserves. As a result of the depletion of reserves, and when more new reserves are in the form of gas instead of oil, Malaysian crude oil production has also slowly declined. Production in 2009 was 553,000 barrels a day. The peak was about 700,000 barrels a day. “We have both a volume and price contraction. We must be wise enough in the use of our hydrocarbon resources,’’ Hassan said. |